All Posts

5 Smart Financial Habits That Changed Everything for Me

Menphiine

Notion Certified Creator

Sunday, December 22, 2024

When I first started my journey with personal productivity and self-improvement, one of the biggest areas I struggled with was managing my finances. Looking back, I realize just how powerful simple financial habits can be. Once I started practicing these consistently, they made an incredible difference—not just in my bank account, but in my confidence and peace of mind.

Here are the top 5 financial habits I wish I’d started sooner:

1. Track Every Dollar Coming In and Out

One of the best things I ever did was start tracking every single dollar I earned and spent. It might sound tedious, but it quickly became second nature, and the insights were priceless. Knowing exactly where your money goes each month is a game-changer—it can help you make intentional choices about what really matters.

2. Set Aside Money for Future Goals

Setting financial goals (whether it’s for a travel fund, a future course, or an emergency savings account) helped me stay motivated to save. Putting aside even small amounts consistently taught me the power of compound growth and long-term planning. Saving is more rewarding when you know exactly what you’re working toward.

3. Embrace Minimalism in Spending

The minimalist mindset doesn’t just apply to decluttering; it’s also helpful for spending. By focusing on the essentials, I became more intentional about my purchases. The trick? I’d wait 24 hours before making non-essential purchases. If I still wanted it the next day, it meant it was likely something I truly valued.

4. Regularly Review and Adjust Your Budget

A budget isn’t a set-it-and-forget-it tool—it’s a living guide that changes with your life. Every month, I take time to review my budget, evaluate my spending patterns, and adjust as necessary. Sometimes this means cutting back on non-essentials to make room for new goals. Other times, it’s about finding areas to optimize, like subscriptions I no longer use.

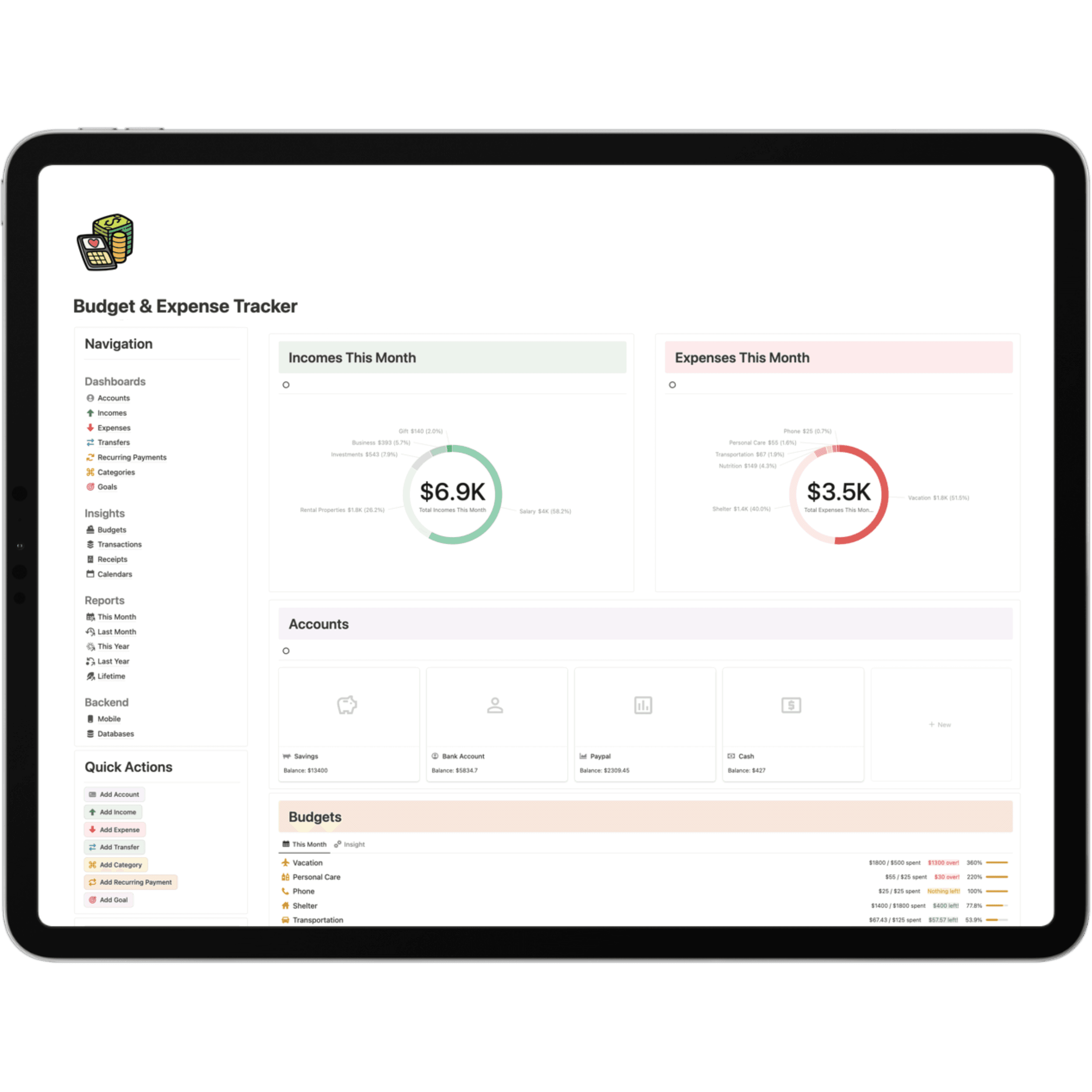

5. Invest in Tools to Make Tracking Easier

At first, I used a basic notebook for tracking finances, but over time, I found tools that could streamline the process and save me time. Having a digital space dedicated to my financial journey makes it easier to stay organized and motivated. That’s why I created the Budget & Expense Tracker—to bring clarity, control, and simplicity to financial management.

If you’re looking to start taking control of your finances or simply want an easier way to track expenses, my Budget & Expense Tracker could be a great fit. It’s packed with features that make budgeting and expense tracking easier, more insightful, and surprisingly fun.

Check out the Budget & Expense Tracker here

Taking these steps has truly been one of the most empowering moves I’ve made. I hope these habits inspire you to start your own journey toward financial freedom. Small steps add up to big changes, and before you know it, you’ll be making progress that seemed impossible before.

Happy Budgeting!

Menphiine

Notion, Finances, Money, Expenses, Budgets, Template

Find more Blog Posts

The Biggest Struggles Notion Creators Face (And How to Overcome Them)

Here’s how to stay organized, scale efficiently, and turn your ideas into polished products.

Apr 3, 2025

How to Stay Consistent with Content Creation (Without Burnout)

Learn how to streamline your workflow, plan ahead, and avoid burnout, all while producing high-quality content effortlessly.

Mar 1, 2025

The Power of Personal Reviews

How to Reflect, Grow, and Stay on Track

Feb 20, 2025